Why Just Naming Beneficiaries or Nominees Is a Dangerous Myth: The Legal Truth Every Indian Family Must Face

Why Just Naming Beneficiaries or Nominees Is a Dangerous Myth: The Legal Truth Every Indian Family Must Face

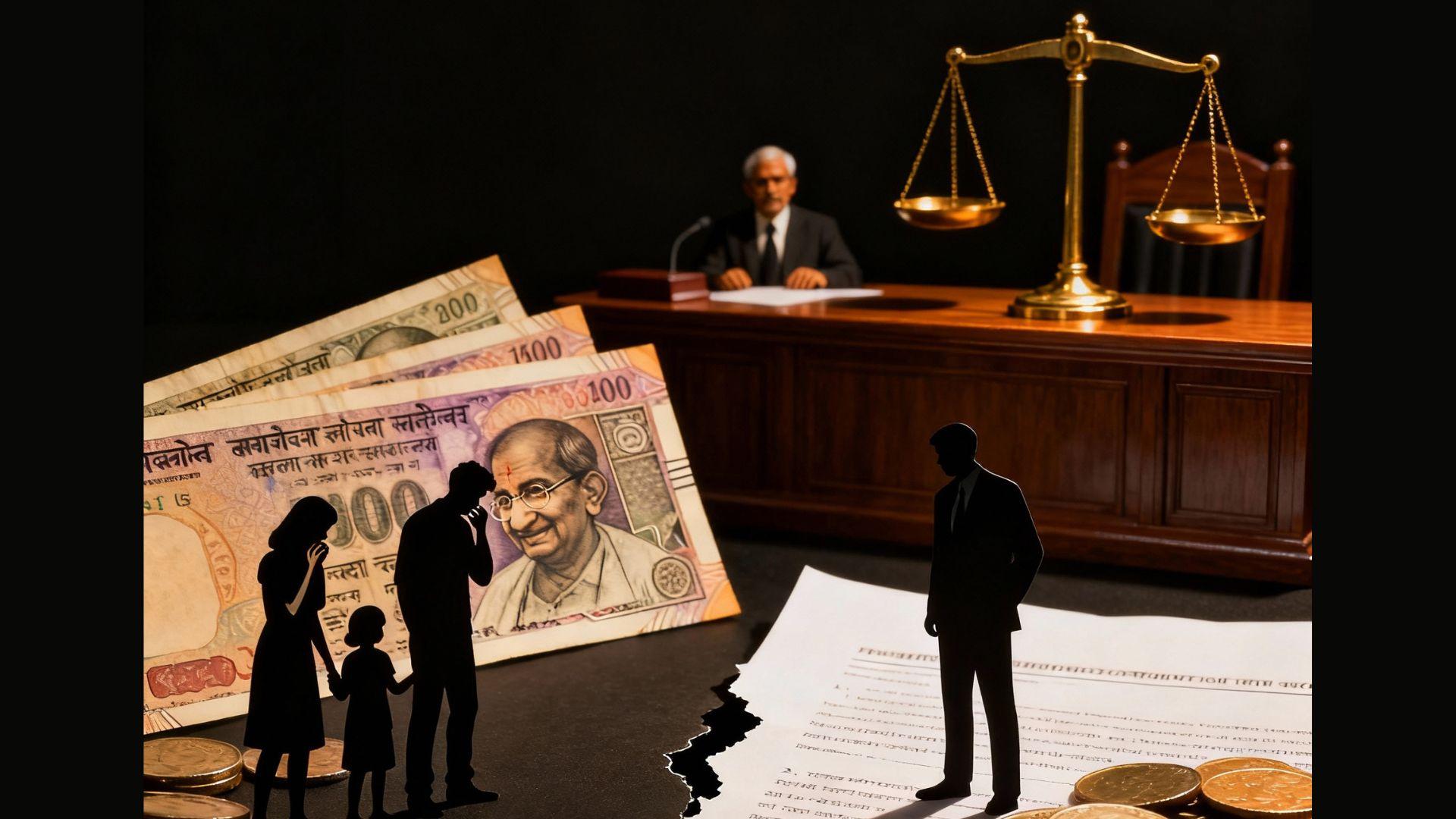

Imagine this: You’ve added your spouse or child as a nominee in your bank account or on your investments, feeling secure that your life’s savings will be theirs without trouble. But what if, after your passing, those very assets end up tangled in court—claimed by others, tied up for years, and maybe even taken from your true loved ones? This is not a distant hypothetical—it happens every single day in India.

The Chilling Legal Reality

Indian law does NOT recognize a nominee as the real owner of your assets. The nominee is merely a caretaker—a trustee, NOT the beneficiary. When you die, your nominee is simply responsible for holding your assets until the courts decide who should actually get them. This means: Your nomination can be overruled by succession laws, legal heirs, and—most painfully—by expensive, drawn-out litigation.

Picture This Nightmare

You named your wife as your bank account nominee. But after your demise, your brothers, parents, or adult children—regardless of your wishes—can legally claim your money. Suddenly, your grieving spouse faces notices, legal hurdles, and, worst of all, battles with family, all because you didn’t write a clear, valid will.

Legal Heirs Override Nominees

As per the Indian Succession Act, 1925, and Hindu Succession Act, 1956, your legal heirs—those defined by strict law, often not by your heart—have supremacy over asset ownership. If you lack a will, your property can be forcibly divided among people you may never have intended to benefit, especially in blended or estranged families.

Nominee ≠ Beneficiary

Nomination only expedites transfer of control—not ownership. Banks, insurers, mutual funds, and demat accounts all clarify: the nominee must hand over assets to legal heirs, as per law, NOT as per your personal wishes. If you want assets to truly go to specific people, only a valid will secures that right.

Real Stories, Real Risks

- Couples who thought a nominee protected them, only to see in-laws or distant relatives claim shares in court.

- Children forced into bitter feuds and expensive legal suits, their education or lives disrupted, because paperwork was incomplete.

- Assets frozen for years—bank accounts, properties, even insurance proceeds—because there was no will, just a nomination.

What’s the Worst That Could Happen?

- Costly court battles: Your assets get locked for months or even years, expenses skyrocketing, while your family struggles.

- Unexpected heirs: Law decides who gets what; your estranged relatives or rivals may inherit what you built for your spouse or children.

- Financial disaster: Hard-earned money is eaten away by lawyers, not used for your children’s future or spouse’s well-being.

- Broken families: Inheritance fights can fracture relationships forever.

Scare Straight: Protect Your Loved Ones, Not Just Paperwork

Relying on nomination alone is like locking your house and handing the keys to a stranger, hoping—without proof—they’ll deliver your belongings safely to your family. Hope is not a plan. Under Indian law, a WILL is the only legal weapon that gives your wishes true power.

Don’t fall into the “nominee myth.” Write a proper will. Register it. Spare your loved ones the horror of litigation, heartbreak, and chaos. Protect your legacy—because in Indian law, only a will makes your voice unbreakable, even after you’re gone.

Let fear motivate action—secure your family’s future not with hope, but with a will.